Water Damage Insurance Claim State Farm

Call 800 sf claim 800 sf claim 800 732 5246 24 7.

Water damage insurance claim state farm. It rained so much that the storm drains could not handle the flow of water. Insurance companies typically cover this type of damage. Water damage is one of the most common causes of home insurance claims according to the insurance services office iso water damage claims are the second largest frequent insurance claim following wind and hail damage. Register or log in then look for profile and preferences make a detailed inventory of damaged property.

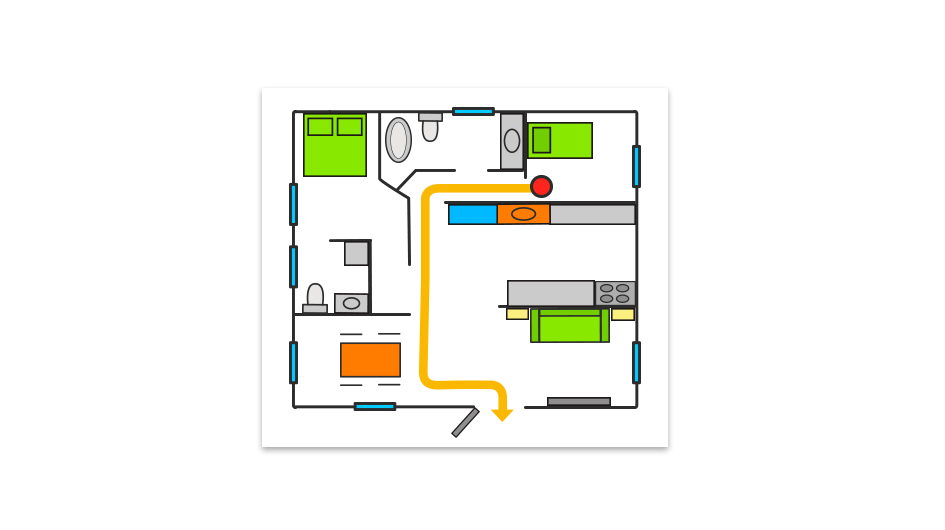

State farm denies your claim stating that the damage was caused by a continuous leak which has occurred over a period of time and therefore not covered under your policy. I am not if a flood area and this has not happened in the 15 plus years i lived here. In fact non weather related water damage is one of the most common home insurance claims and one of the most expensive. If you are experiencing water damage in your home you may want to file a claim to get the problem taken care of.

Use the state farm mobile app. You can also file your claim by calling 800 sf claim 800 732 5246 24 7 or contact your agent if you prefer. Homeowners insurance doesn t cover damage caused by floods and might not cover other water damage. Flood insurance pays to repair your home if it s damaged by rising water.

Here are some examples. If your water damage claim develops from any of the above situations a typical rv insurance policy will usually deny the claim. It s a separate policy from your homeowners. Start your claim online or with the state farm mobile app.

On the other hand there are times when home insurance won t cover you for mold damage. Sign up for notifications. If you want protection against these types of water damage issues you will need to speak with your insurance agent about getting a full water damage policy. If you have state farm homeowners insurance it will protect you from a number of different types of water damage.

Minor water damage from something like a burst pipe is generally covered by a state farm homeowners insurance policy but a flood caused by an external source like an overflowing. These are sudden and accidental incidents. Get text and emails about your claim. Water damage to your home can be expensive and time consuming to repair.

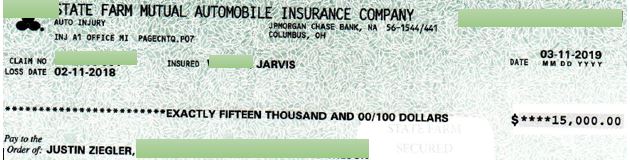

Contact your state farm agent. You contact state farm to submit a claim in the hopes that it will be approved and you can begin making repairs before the leak gets worse. Types of water damage coverage flood insurance. State farm will review claim details.